The North of England is at the forefront of a leisure revolution, incubating innovative brands and experiences that are making waves both nationally and globally.

This transformation was the focus of a recent seminar, Leisure in the North – Trends and Developments, organised by the Leisure Property Forum and hosted by TLT in the stunning Eden Building, Salford.

Our Account Director, Tom Tawell, attended the event to explore the key factors shaping the future of leisure in the North and beyond. Here are his top eight takeaways…

1. The Northern Launchpad for Leisure Innovation

From pioneering concepts like Museum of Illusions in Manchester to Lane7 in Newcastle, Junkyard Golf Club in Liverpool, and Maki & Ramen in Leeds, the North is setting a new standard in leisure – redefining the sector at home and overseas.

Manchester, in particular, has cemented its status as a global city, thanks to its two iconic football clubs, world-class venues like Manchester Arena and Co-op Live, and major retail and leisure destinations like the Trafford Centre and Manchester Arndale. MediaCity, home to giants like the BBC, ITV, and Warner Bros., further underscores the city’s prominence on the international stage.

Meanwhile, the Trafford area is quickly transforming into one of the UK’s most dynamic leisure hubs, bolstered by projects like Therme Manchester, the UK’s first city-based wellbeing resort, complete with 35 water slides and its very own beach!

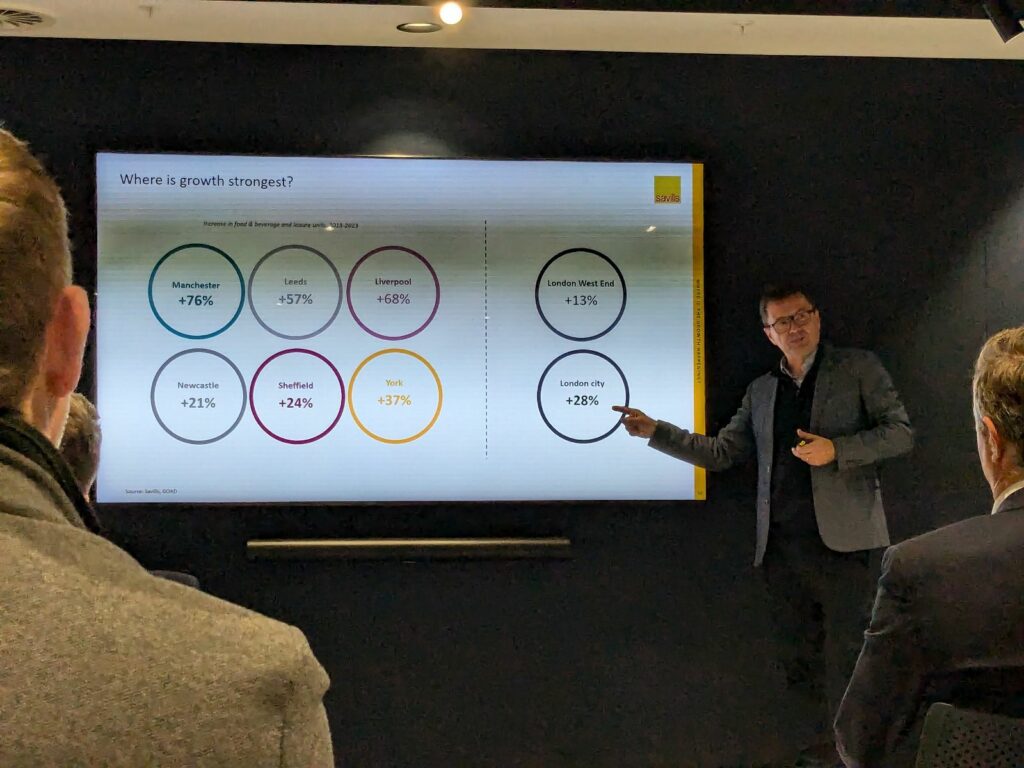

Research by Savills, presented at the seminar, revealed that Manchester has experienced a remarkable 76% increase in food and beverage (F&B) and leisure units between 2013 and 2023, with Liverpool chasing in second place at 68%. In contrast, growth in London’s West End (+13%) and the City (+28%) has been more modest, reflecting the challenges of limited space and high property saturation. This comparison underscores the North’s emergence as a launchpad for leisure innovation and a driving force in moulding the direction of the industry.

2. The Rise of Experiential Leisure

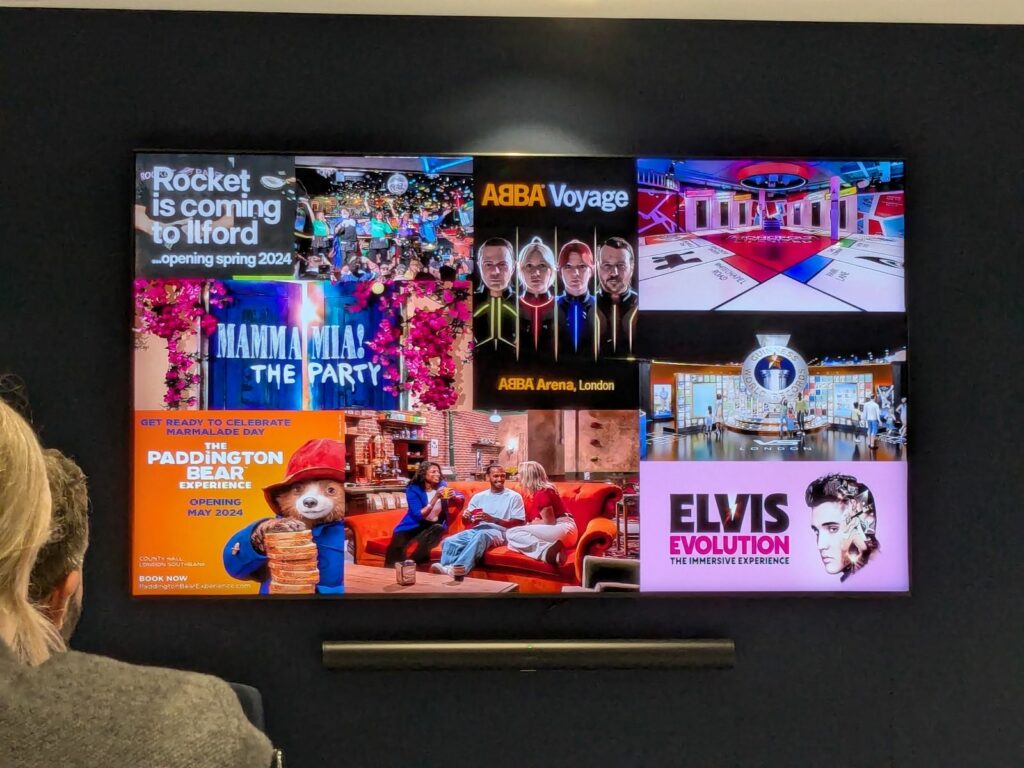

There’s no doubt: the future of leisure is experiential. Consumers are seeking more than traditional entertainment – they crave immersive, interactive, and memorable experiences. Intellectual property (IP)-driven attractions like ABBA Voyage, The Paddington Bear Experience, and Monopoly Lifesized are propelling leisure into a new, icon-fuelled era.

The questions are: How far can intellectual property (IP) extend within the leisure sector? How much value does an IP brand add to the price point? And will people continue to pay a premium for such experiences? During Toolbox Marketing’s recent study tour of The O2, we saw first-hand the staggering queues for Mamma Mia! The Party, which is reportedly always fully booked. With tickets starting at £120, it’s clear that audiences are willing to splash the cash to step inside their favourite films!

As these concepts grow, we can expect an increasing focus on blending nostalgia, storytelling, and interactivity to captivate audiences. For destinations, this trend means embracing IP-driven attractions to differentiate offerings, boost footfall, and create lasting appeal.

3. Bridging the City-Town Divide

The gap between cities and towns is widening. While cities have greater resources and the ability to attract investment, towns, no matter how affluent, have “capacity ceilings” to contend with. However, examples like Barnsley Council’s transformation of the Metropolitan Centre into The Glass Works (developed by Queensberry) show how towns can successfully reinvigorate themselves by focusing on mixed-use developments – going from “ghost town” to six million annual visitors.

By offering a blend of shopping, dining, leisure, and essential services, these spaces have the power to attract high-profile tenants, such as Flannels, JD Sports, Starbucks, and Superbowl, drawing footfall to the destination and town as a whole.

4. Cinema: The Need for Evolution

Cinema attendance has plateaued, with around 75% of the adult population attending the movies*. However, to thrive, cinemas must evolve. Premium experiences like Everyman Cinema are leading the charge with smaller, more intimate screens, luxurious seating, table service, and high-quality food and beverage offerings. At Toolbox Marketing, we say that “retail isn’t dead; boring retail is”. The same holds true for leisure: those who fail to inspire will risk extinction. Everyman gets this and is paving the way for others to follow.

At the same time, however, operators are grappling with financial sustainability. Cineworld’s recent restructuring brought this into sharp focus, highlighting the urgent need for cinemas to reimagine their business models and adapt to changing consumer preferences. The company faced severe financial strain from the COVID-19 pandemic, rising competition from streaming services, and delayed film releases due to Hollywood strikes, alongside a multibillion-dollar debt burden. This led to measures such as site closures, lease renegotiations, and restructuring plans to cut costs and secure new funding. These challenges reflect broader industry pressures, necessitating innovation to remain viable in a rapidly evolving market.

5. Competitive Socialising: The Growth Engine of Leisure

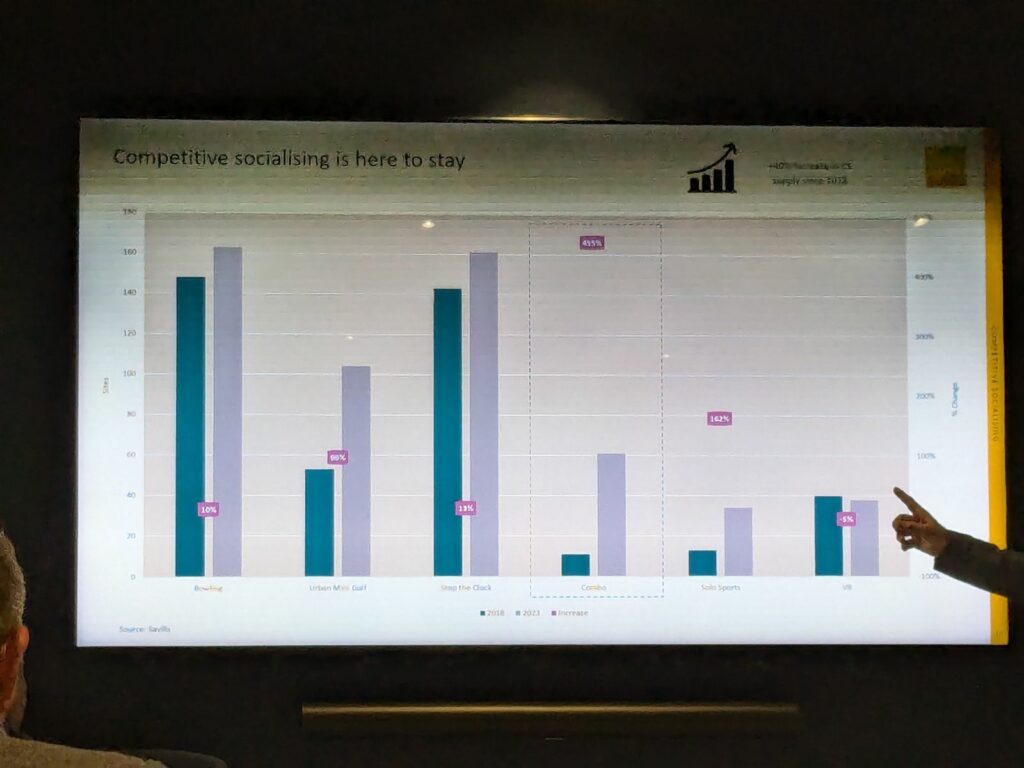

Competitive socialising (or “comp soc,” as the cool kids say!) is one of the fastest-growing areas in leisure. Activities like mini-golf, axe throwing, and interactive darts are booming – particularly when offered as a “combo” experience, with participation up 455%* since 2018. These dynamic offerings are transforming former retail and “standard” leisure spaces into exciting, multidimensional destinations.

6. Sport and Food: Diversifying Leisure Offerings

Sports-based leisure, particularly paddle courts, is exploding in popularity. While London leads the way, court hire in the capital is around £80 per hour, compared to a more affordable £30 in the North. This sport is set to keep expanding as infrastructure improves and costs become more accessible. Industrial units on the outskirts of towns and cities are prime candidates for conversion into paddle centres, so keep an eye out for these emerging venues!

Meanwhile, food halls are continuing to spring up nationwide, offering curated, culinary experiences. These dynamic hubs are set to thrive, though their expansion may impact nearby food and beverage outlets, as people are drawn to these vibrant, purpose-built spaces brimming with energy and diverse dining options all under one roof.

7. Mid-Market Offerings Being Squeezed Out

Both premium and quick-service leisure concepts are thriving, but mid-market offerings risk falling by the wayside. Consumers increasingly gravitate towards two ends of the spectrum: luxury and exclusivity on one side, and quick, affordable options on the other.

High-end concepts succeed by offering unique, indulgent experiences that justify their higher price points, while quick-service options appeal through convenience and value. In contrast, mid-market offerings struggle to carve out a distinct identity, often being perceived as neither exceptional enough to warrant a premium price nor affordable enough to compete with budget-friendly alternatives. As a result, businesses in this segment face growing pressure to innovate or risk being squeezed out of the sector.

8. Leisure as the Anchor of Destinations

As urban planners and developers reimagine town and city spaces, leisure is emerging as a key anchor. The challenge for places of all sizes is keeping people engaged in and outside of work hours. The question is: how can we prevent people from jumping in their cars or catching a train home at 5:30 pm? By cultivating vibrant, diverse ecosystems of retail, leisure, and F&B offerings, towns and cities can encourage longer visits, foster deeper connections, and drive increased consumer spending.

Leisure is also increasingly becoming the main anchor for what were once traditional retail destinations. To remain relevant, these spaces have had to diversify, transforming into mixed-use schemes that integrate cultural, recreational, and social experiences alongside shopping. Instead of retail driving leisure, the script is shifting, with leisure now driving retail – or at least achieving greater equity in the relationship.

Summing Up…

The North’s pioneering approach to leisure serves as an inspiration for the rest of the UK. With its emphasis on first-of-a-kind experiential offerings, the future looks bright, not just for the region but for the broader leisure industry as well.

Particularly in “comp soc,” the UK is best in class, capturing attention on the global radar. By continuing to embrace change, foster creativity, and challenge traditional concepts of what a destination should offer and look like, the sector is truly changing the game. This evolution will enable it to adapt to evolving consumer demands and unlock exciting new growth opportunities for our destinations.

Discover how we can help you unlock the latest retail and leisure trends to elevate your destination. Contact us today at marketing@toolbox-marketing.co.uk or call 01359 358600.

*Savills Research presented at the Leisure in the North – Trends and Developments Seminar.